|

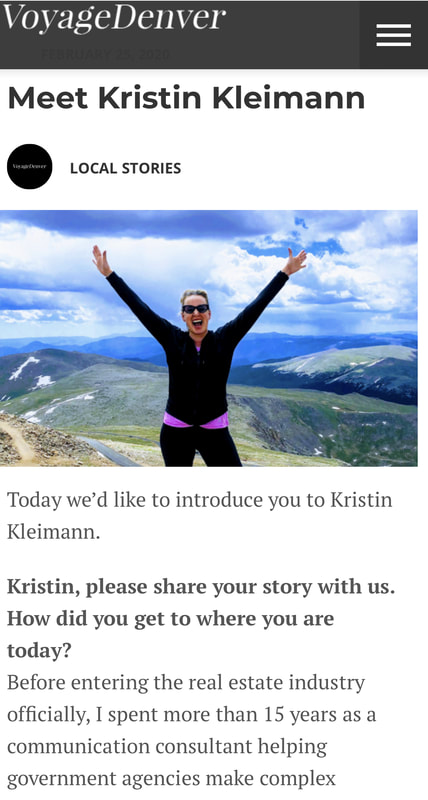

Kristin Kleimann was recently interviewed and featured on VoyageDenver online magazine. VoyageDenver's mission is "to promote mom and pops, artists, creatives, makers and small businesses by providing a platform for these hidden gems to tell their stories in their own words." Kristin was thrilled to be included. Click here for the link to the full interview on VoyageDenver. From the VoyageDenver website: "Today we’d like to introduce you to Kristin Kleimann. Kristin, please share your story with us. How did you get to where you are today? Before entering the real estate industry officially, I spent more than 15 years as a communication consultant helping government agencies make complex information clear and usable. As part of my communication consultant work, I worked with the Consumer Financial Protection Bureau (CFPB) on the “Know Before You Owe” project to design new mortgage disclosures –the Loan Estimate (formerly the Good Faith Estimate) and the Closing Disclosure (formerly the HUD-1). These mandatory disclosures were implemented in October 2015 and help consumers choose a mortgage that is right for them and then help consumers understand what, if anything, changed between the loan estimate and closing. They are also help consumers better use, compare, and understand complex mortgage information and terms. The disclosures have been called “understandable,” “transparent,” and “fair.” After working on these forms, I decided to get my real estate license, in part, because I knew I could help my clients better navigate the complex real estate buying and selling process by making it simple, transparent, and personalized. For me, getting my clients into the right house with the right mortgage is a core value. Has it been a smooth road? The real estate industry, market, and even the forms we use, are constantly changing and evolving. This is part of what makes being in the industry both exciting and challenging. That said, it requires constantly educating yourself on national, state, and local changes, so you can best serve your clients. I read — a lot. We’d love to hear more about your work. I’m a lover of Colorado and Denver, especially when it comes to art, design, food, nature, entertaining, family, and travel. In both my work and home life, my focus is often research and education. I enjoy learning and then sharing useful, usable, and relevant information, with my clients and friends. I give my clients my full attention and love working hard for them. My clients appreciate my knowledge, expertise, and quick response. It makes me happy to make my clients happy. How do you think the industry will change over the next decade? The real estate industry is ever evolving and changing. For instance, in a hot real estate market like Denver, it can sometimes be challenging if a client needs to sell a home before they can buy another. The emergence of i-Buyers (like Zillow Instant Offers, OpenDoor, etc.) can help streamline the selling process by giving sellers the cash they need to purchase a new home quickly. While many of the i-Buying companies have some initial requirements with homes, (some want homes less than 25 years old, or won’t purchase any over a certain amount, etc.) it can be a good option for some clients. Someone thinking of using this model will definitely need to compare cash offers and the costs associated (some charge a “service fee” that is greater than a full-commission;), along with other pros and cons, against the net proceeds they would come away with if they had used a full-commission real estate agent/broker. The real estate industry will continue to evolve quickly as technology improves and disruption occurs. The client experience will be paramount. A smart agent will need to know how to adapt, or risk obsolescence." Contact Info:

0 Comments

This recent article from Consumer Reports provides consumers with information about how to save money on mortgage fees by:

1. Obtaining several loan estimates As the article states, "Your best tool to comparison-shop mortgage fees is a Loan Estimate—a free, standardized form that you can request from each lender." The company I used to work for, Kleimann Communication Group, Inc. and I, prior to entering real estate, helped the Consumer Financial Protection Bureau (CFPB) develop this consumer friendly tool. The Loan Estimate breaks down the total cost of a loan, "so you can compare loans, apples to apples." Other ways to reduce your fees include: 2. Avoiding or minimize junk fees 3. Shopping for or negotiating on fees you can control 4. Questioning fees that appear to be out of your control 5. Preparing for closing fees you can't avoid To read the full article and get more detail about how to save money, please click the link below: https://www.consumerreports.org/mortgages/how-to-save-money-on-mortgage-fees/  Good news for consumers! New integrated and simplified mortgage disclosures must be implemented by August 1, 2015. Kristin Kleimann, Licensed Realtor and Consultant with Kleimann Communication, Inc. The Dodd-Frank Wall Street Reform and Consumer Protection Act (Dodd-Frank Act) mandated the Consumer Financial Protection Bureau (CFPB) to combine and simplify existing mortgage disclosure forms. While the new forms and accompanying regulation rule were released in November 2013, lenders have until August 1, 2015, to implement the new forms and regulation rule. To be an educated consumer or to be able to assist and educate consumers, here are some key points both consumers and industry professionals should know: The Good Faith Estimate (GFE), the HUD-1, and some aspects from the Truth-in-Lending Act (TILA) disclosure have been replaced by a pair of new documents--now known as the “Loan Estimate” and “Closing Disclosure.” The new forms were rigorously tested, refined, and validated using consumer and industry feedback in order to ensure they are easier to use and understand. In addition, they were designed to be used as a consumer tool to shop for a mortgage as well as to compare costs from loan application to closing. The key benefits of the new forms and rules include:

From CFPB’s publication, “What the new simplified mortgage disclosures mean for consumers.” (November 20, 2013) To see what the new disclosures will look like, visit: For the Loan Estimate (replacing current Good Faith Estimate and initial truth-in-lending): http://files.consumerfinance.gov/f/201311_cfpb_kbyo_loan-estimate.pdf For the Closing Disclosure (replacing current HUD-1 and final truth-in-lending): http://files.consumerfinance.gov/f/201311_cfpb_kbyo_closing-disclosure.pdf Additional Information For more information on CFPB’s “Know Before You Owe” project, please visit: http://www.consumerfinance.gov/knowbeforeyouowe/ For more information about the testing of the disclosures, please visit: http://files.consumerfinance.gov/f/201311_cfpb_factsheet_kbyo_testing.pdf About the Author Kristin Kleimann is a licensed Realtor in the State of Colorado with Edelweiss Realty, Co. She is also a consultant with Kleimann Communication Group, Inc. who collaborated with the Consumer Financial Protection Bureau to design and test these disclosures. She specializes in helping clients navigate the complex real estate buying and selling process and is a proponent of Realtor and consumer education. |

Categories

All

Colorful ColoradoSharing Colorado, Denver, real estate, and home related news and information... Archives

July 2024

|